I, Tep Sethanna, Chairman of the Board of Directors and Co-Founder of KEPA, would like to express my pleasures, joy and great pride in what I was trying to do and what I am achieving currently, including my PhD, professional skills in accounting, auditing and taxation, as well as my accumulated work experience and leadership ability in the accounting, auditing and taxation fields for more than two decades. I am also a Cambodian who was born into a family of farmers in O-Baktra Village, Prongil Commune, Phnom Kravanh District, Pursat Province. This is a family that does not have good financial resources but has many family members. Although I am not a son of a wealthy family, I still have a clear vision that I am also a resource who can contribute to building and developing the accounting, auditing and taxation profession with the Accounting and Auditing Regulator (ACAR) and General Department of Taxation (GDT), simultaneously, Cambodia is currently developing in almost all sectors to achieve high economic growth towards to the long-term development strategy of the Royal Government. In particular, the Royal Government’s policies are providing many incentives for domestic and foreign investors, including informal traders, to engage in business with transparency, equality, and compliance with Commercial Laws, Law on Taxation, Labor Laws, National Social Security Fund Laws, Accounting and Auditing Laws, and Cambodian Investment Laws, as well as to comply with applicable directives, rules, and procedures.

At the same time, the actual situation, whether local or foreign business owners, when they decide to register a business in Cambodia, most of them do not have the time to study and understand the requirements of the laws, rules and procedures clearly. What they focus on most is to ensure that their supply chain is sustainable and grows regularly. They do not pay close attention to the obligations to maintain accounting records and report to the tax administration properly and do not receive regular updates from all regulators that are their main guardians. In particular, they do not clearly understand what the rights and obligations of taxpayers and the authority of the tax administration are. These gaps are the reason why they are highly exposed to acts of obstruction of the implementation of tax regulations and are subject to administrative penalties or the implementation of additional taxes and interest, etc. These severe challenges have made them lose control and felt lost confidence in continuing to do business.

This is the main reason that motivates us to establish KEPA with the aim of contributing to filling all those gaps, including maintaining their financial well-being and stability on a regular basis. At the same time, I would like to express my deepest gratitude to all customers and business partners who always support every aspect of what we have and wish you happiness, freedom from suffering, and prosperity. I would like to always accept all criticisms and improvements from you in order to correct all shortcomings.

Chairman

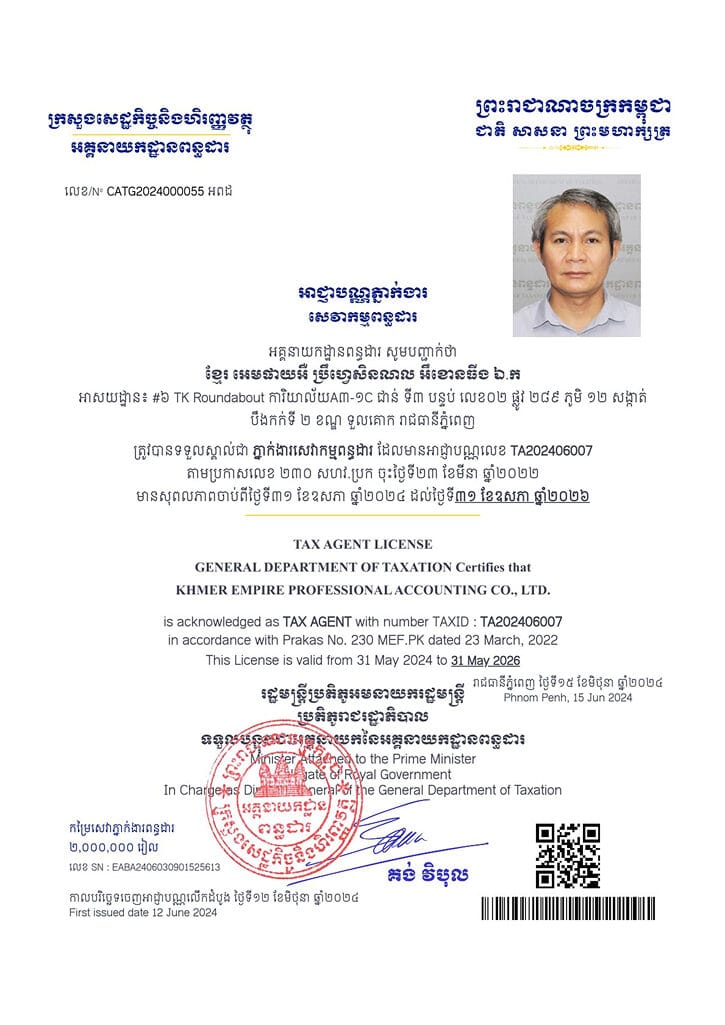

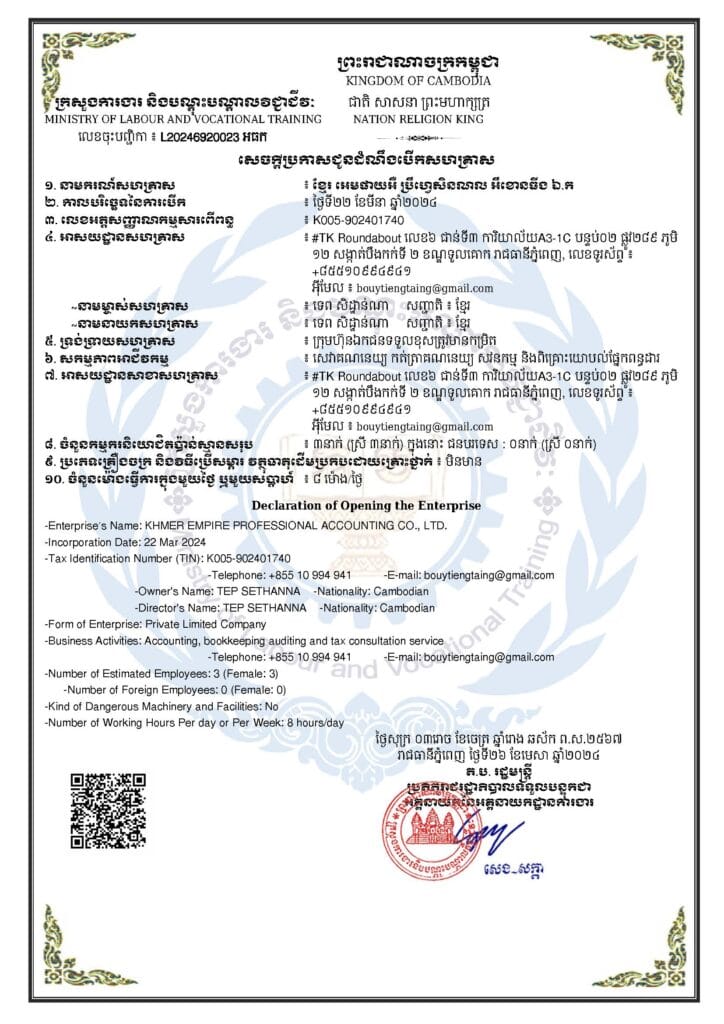

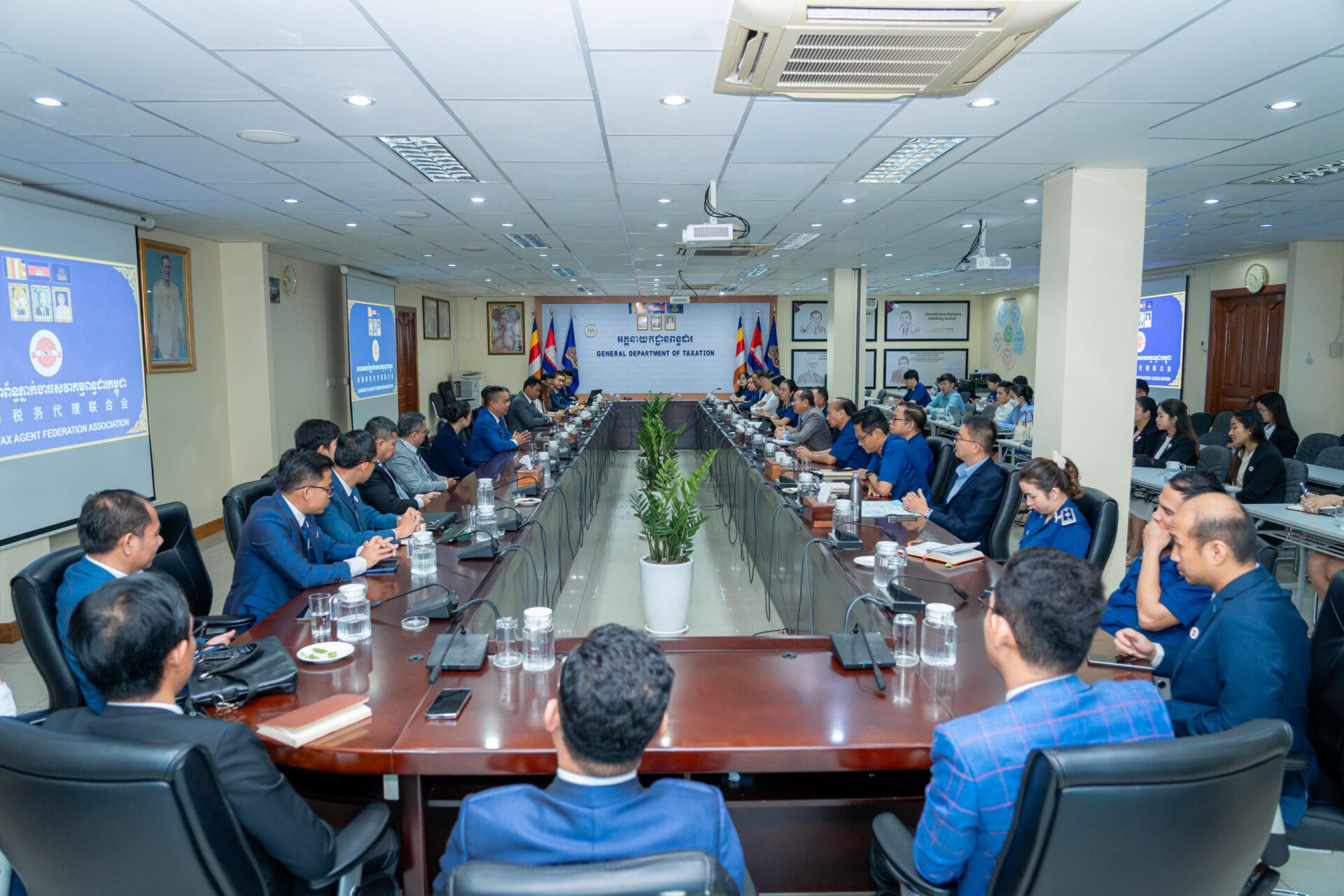

KEPA is certified by Cambodian regulators to provide comprehensive Accounting and Taxation services. Superior client service is our primary objective and guiding principle, adhering to legal and professional standards. Our leadership team includes H.E. Dr. Tep Sethanna as Managing Director and Miss Nut Samolya as Chief Executive Officer. The management structure comprises registered accountants, tax specialists, and a dedicated professional team.

KHMER EMPIRE PROFESSIONAL ACCOUNTING CO., LTD (KEPA) is officially registered with the Ministry of Commerce, General Department of Taxation, and certified by Accounting and Auditing Regulator (ACAR). We are providing comprehensive Accounting and Tax Services from our based in Phnom Penh, Cambodia. Our conduct both as individuals and as a firm, reflects our dedication to the integrity of the accounting and tax profession. KEPA has assembled a team of experienced professionals dedicated to the fields of accounting and taxation in Cambodia.

Our long-term vision, mission, goals, and objectives focus on enhancing our clients’ financial health through our expertise, knowledge, and persistent efforts. We carefully select our clients to ensure they possess the appropriate levels of integrity and are positioned to benefit from our professional relationship. We aim to help our clients define and achieve their personal and business goals, recognizing the importance of aligning these objectives with their current operations. By establishing clear goals for the businesses we serve, we can tailor our services to meet their specific needs.

Over the years, KEPA has successfully supported a diverse range of clients, particularly in challenging situations, earning their trust and appreciation for our commitment to quality service. To fulfill our mission, we are dedicated to providing a high level of service that complies with both professional and ethical standards. Our approach ensures that clients receive reliable and effective support for their accounting and taxation needs, ultimately contributing to their overall financial well-being. We are leveraging our international team’s talent, determination, and influence to invest in a better tomorrow.

In accordance with our certified license, we are dedicated to delivering a comprehensive range of services, including:

“IT IS BUILDING PROFESSIONAL CAPACITY RESOURCES TO PROVIDE HIGH-QUALITY INNOVATIVE SERVICES AS A DRIVER OF ENTREPRENEURS’ SUCCESS”

"Building Trust Through Transparency". It’s our mission to represent the firm's beliefs and our understanding of how we work and provide services to our clients. The mission statement highlights KEPA’s dedication to building trust with clients by being transparent about financial matters.